Contents

It’s estimated that around 1,000 new architectural firms start up every year. Sadly, only 25% of those new firms will be in business 3 years later. According to the American Institute of Architects, the number one reason they fold is lack of capital to see the firm through lean times.

The news is constantly teasing us with estimates of an upcoming recession. Good design and passion alone won’t carry your firm through those future recessions. You owe it to yourself and your employees to manage your firm’s money well.

Table of Contents

- Overview

- Create a Business Plan

- The Order of Financial Management

- Revenue Projection

- Talent Plan: Bridge the Gaps

- Overhead Expense Budget

- Profit Planning

- Financial Management Keeps the Boat Afloat

- Additional Resources

Create a Business Plan

When you first set up your business, creating a business plan will be one of the most important things you do.

A business plan is a road map. It doesn’t need to be a big complicated document. For most firms, even a one-page plan will do. Regardless of how long it is, every business plan should include your vision, mission, goals, and actions for reaching those goals.

An important part of any business plan will be your finances – this is where revenue projection, talent plans, overhead expense budgets, and profit plans come into play. Not only will the financial part of the plan help you prioritize and set realistic goals, but potential investors like to see that you know where you are going.

It’s important to realize this plan is not a static document. You will need to update it regularly to reflect changes to your firm and new goals.

Picking the Right Type of Business Plan

Most architects will design their practice around a design-bid-build or a design-build model. The essential difference is a firm who only does the design work versus a firm that wants to have both design and construction under one roof. To make matters more complicated, there are lots of variations within the two models.

Your goals, actions, and overall business plan will depend greatly on what model you use. Creating a business plan that is specific to the type of model you want to use will make the plan more usable.

The Order of Financial Management

As you read through the different components of financial management in the rest of this article, you might start to notice that they are all closely related and intertwined. The decisions made at one stage will influence all the other stages of financial management. You might start to wonder where you should start and if it matters where you start.

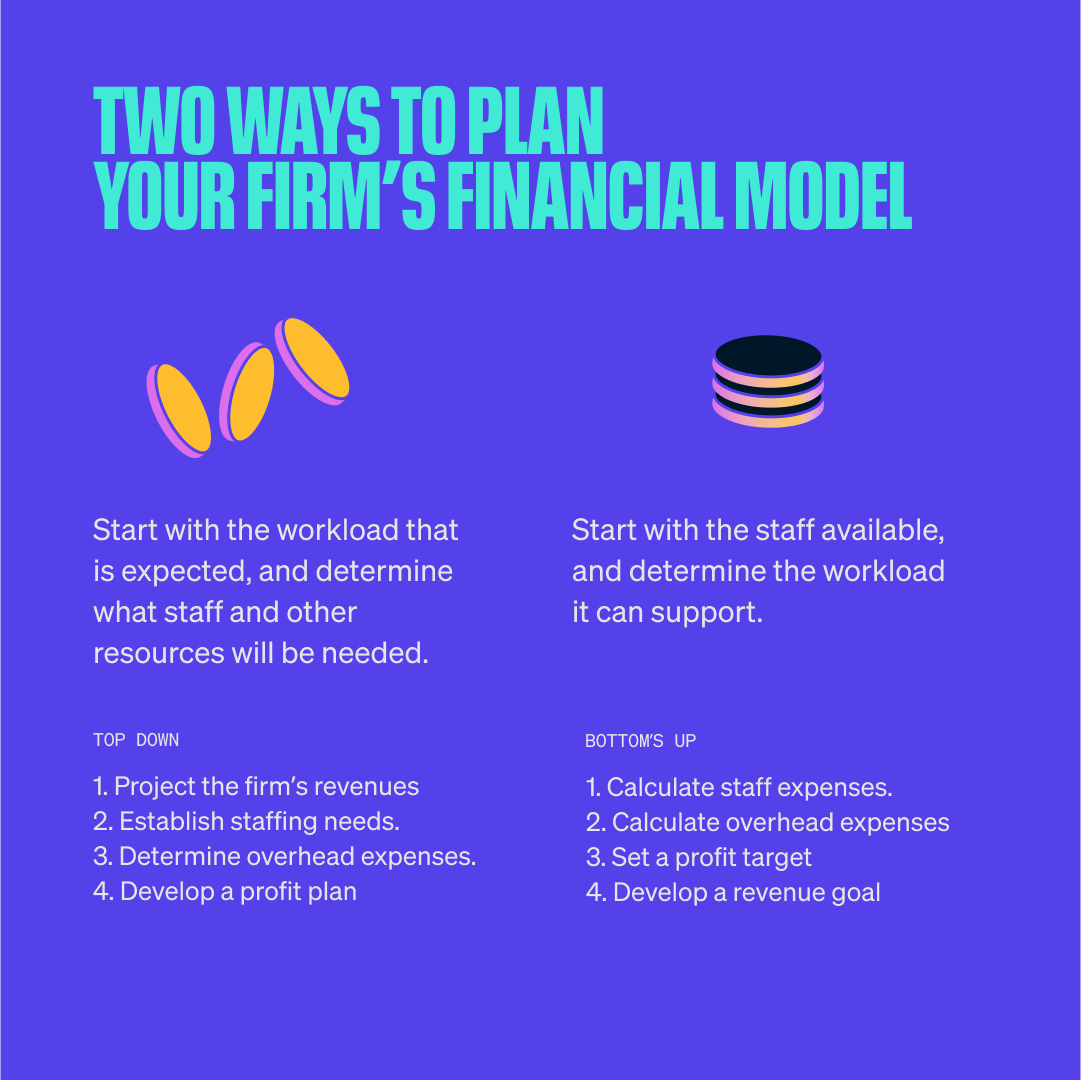

The Architecture Student’s Handbook of Professional Practice published by the American Institute of Architects (AIA) recommends two potential paths depending on where you are in the process.

- Path A. Start with the workload that is expected, and determine what staff and other resources will be needed.

- Path B. Start with the staff available, and determine the workload it can support.

According to the AIA, the sequence of events for both paths would look like this:

Path A

- Project the firm’s revenues

- Establish staffing needs.

- Determine overhead expenses.

- Develop a profit plan

Path B

- Calculate staff expenses.

- Calculate overhead expenses

- Set a profit target

- Develop a revenue goal

It’s important to go through all the steps and fill in all the boxes when doing financial planning. You never know what you might miss. Just as for architectural design work, especially in the planning phase, it’s important to have all the information.

Revenue Projection

Simply put, the projected revenue is the money your firm expects to make in a specific time period. Typically, you will run these projections for monthly, quarterly, or annual accounting periods. What you use depends mostly on your business.

Why is this important? First, potential investors will want to see it. Also, you will use the projection to develop operational and staffing plans. Your revenue is the lifeblood of your firm and you need to know if you will have enough to keep things alive.

Creating a revenue projection can be a lengthy process, especially if you want to create an accurate forecast that has value.

To create your revenue projection, you will use research and internal knowledge. Some examples include reviewing previous sales, talking to your marketing team, contacting clients about future needs, and reading predictions on design and business trends.

A big part of creating revenue projections (and the other parts of financial management) is using software. There are many different services out there to manage every part of financial management. Take advantage of them – they only make things easier.

For an architect, a revenue projection will cover the following:

- Backlog (Existing projects to be completed)

- Proposals that are outstanding

- Unidentified future work

The project backlog is work that has been approved but still needs to be completed. Think of it as an incoming paycheck from existing fee contracts. You are almost 100% sure that work will be completed in that time and you will be receiving those payments.

You should shoot for a backlog volume (the dollar amount for that work) that is equal to, or greater than, the annual net operating revenue. If the backlog is decreasing, it’s a sign that you will run short of work and revenue in the coming year. If the backlog is increasing, this might be a sign that you need to look at your staffing plan and increase your staff.

Proposals that are outstanding include all the work that you have submitted proposals for and are waiting to see if you win the project. When looking at revenue forecasting for these projects, you will need to estimate when the work will take place. You will also have to multiply the revenue for each project by a probability factor. This probability factor is based on the chances of you winning that work.

Say you have four outstanding proposals that would generate $400,000 in total fees. For each proposal, you apply the probability factor and end up with $205,000 in fees for your forecasting. This is a standard industry practice that allows you to account for the fact that you likely won’t win every single project.

Unidentified future work demonstrates the work that must be found to bridge the gap between the revenue you will have from your backlog and outstanding proposals. It represents the work you will need to put in to find additional projects and clients in the coming year.

Talent Plan: Bridge the Gaps

When you are looking at significant growth based on the revenue predictions, it’s time to develop your talent plan or staffing plan. A talent plan will help you bridge the gaps between your firm’s needs and its resources.

Just like every part of financial management, having a methodical process is important, even if it feels like a waste of time. You never know what little detail will sneak in and derail your whole plan. Here are some basic steps you should go through when developing your talent plan:

- Define your business goals.

Your talent plan should be in line with your business plan. Look in your business plan to find out what your plan for growth is. Are you hoping to open more offices? Do you want to expand the types of services you offer? Knowing the answers to those types of questions will help direct the direction you go with your talent plan.

- What are your talent options?

Know what the overall job market looks like. Know the unemployment rates, the number of job openings, and labor costs. Knowing all of this will help you form your plan – especially the money you will need to have available for salaries.

- Identify your needs.

What help do you need? What problems is the talent plan attempting to solve? Sometimes you will find that your needs can be served by reorganization internally. You don’t always need to hire externally. The work could also be outsourced to consultants, freelancers, or contractors. If you determine that you can rearrange your current staff to meet the companies needs, what training or help will they need to complete the tasks?

- Gap Analysis.

Now that you know exactly what you need, compare it with what you have. This is called gap analysis. How can that gap be filled? With more training for employees? With a new hire? Is this a seasonal need that can be contracted out?

- Create a talent plan.

Use the answers unearthed in the steps before creating your talent plan. Outline the steps you went through to get to the plan, so anyone can follow your thoughts.

When developing a talent plan as a service-based business, it’s important to consider the billing rates. This should be on your mind throughout all the steps of the process. Will your goals and needs require someone with more experience, or can the gap be covered with a few interns? Interns and experienced professionals will have different billing rates and that difference will influence the financial side of a talent plan.

Your staff’s billing rates are higher than just the rates you charge your clients. Don’t forget to include things like salary increases for your current staff, holiday and vacation time, and a budget for education for your staff when creating your staff plan.

Overhead Expense Budget

Your overhead expense budget is a look at your total overhead costs. The main metric that matters here is the overhead rate. The overhead rate is how much overhead is attached to each dollar of direct labor charged to a project. Not knowing this rate means you don’t know if your firm’s profitability, so this is an important metric to get your head around.

You should run these calculations for a twelve-month period, as there are overhead expenses that should be evenly spread over the twelve months.

The overhead rate is simple to calculate. Take the total overhead costs, also known as indirect expenses, and divide by the direct labor cost. The total overhead costs are a mixture of fixed and variable expenses needed to run a business, like rent, utilities, promo material, office supplies, and travel. The direct labor cost is how much you have charged the client for a project.

Having a lower overhead rate is a good thing, but the nature of architecture means the rate won’t ever be below 100%. An industry norm is 150% to 175%. This means that for every dollar of direct labor charged to a project, $1.50 to $1.75 in overhead expenses are also charged. The 2016 average across the industry was 154%.

A rate above 175% means that overhead expenses need to be better managed. Having an overhead rate that high should make you concerned and should prompt you to immediately act.

Profit Planning

Your profit is what is left over after you pay for all your expenses. Profits are required to provide bonuses to employees, to fund capital expenditures, and to reward the owners of the firm for their risk. Importantly, some profits are reinvested in the firm.

Most of the time you won’t know what your profit was or if you even had any profit until you complete your tax return – typically in March at the earliest. However, bonuses for employees are nice to have prior to Christmas. This is traditionally when bonuses are given.

This is where profit planning comes into play. A profit plan is also called an operating budget and it helps inform you of how much profit you will likely have.

Here are important steps to creating your profit plan.

- Develop an estimate for your net expenses.

Don’t include any expense that the client ends up paying for. Only the ones that ultimately come out of your pocket.

- Develop a profit goal.

This is how much you would expect to see in return on your expenses and it is listed as a percentage of your expense. Some recommendations are a 20% return, meaning you should see a 20% return on the expenses you calculated in step one.

- Next, develop your net revenue goal.

Add your profit goal to the net expenses developed in step one. Your net revenue goal tells you how much you need to charge your clients to meet your financial goals.

The AIA’s Architecture Student’s Handbook of Professional Practice lists examples, not just for profit planning, but for all the concepts we have gone over. Follow their extensive examples (they are fantastic), if you feel like you need more help with financial management.

Financial Management Keeps the Boat Afloat

All this planning and calculations might seem like a huge waste of your time. Everyone wants to just focus on the design work – it’s more fun. Plus, you might think that focusing on great design is the key to a successful business.

It’s certainly a key, but there are multiple keys and proper financial management is one of them. Think of your firm as a boat with a hole in the bottom. You hold the bucket. It’s your job to keep the water coming in and going out balanced and the whole thing afloat.

Additional Resources

- The AIA Architecture Student’s Handbook of Professional Practice

- How to Draft A Business Plan

- Architecture Firm Business Plan Example

- 15 Crucial Financial Metrics for Architectural and Engineering Firms

- 10 key financial performance indicators for architecture and engineering firms

- 5 Steps to an Optimal Staffing Plan

- Profit Planning

- Entrepreneur Architect Academy How To Become The Richest Architect You Know (Part 1 of 3)